The director has been returned 79K already. If you take out a 100000 loan it shifts to 600000 100000 500000.

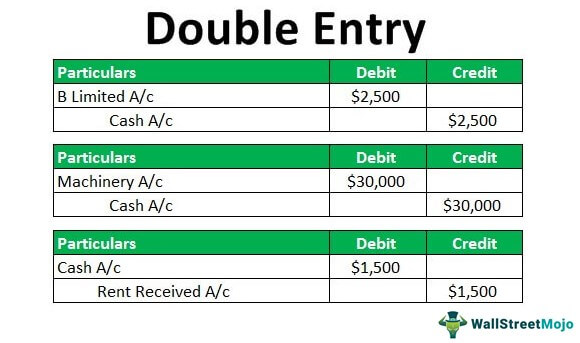

General Journal In Accounting Double Entry Bookkeeping

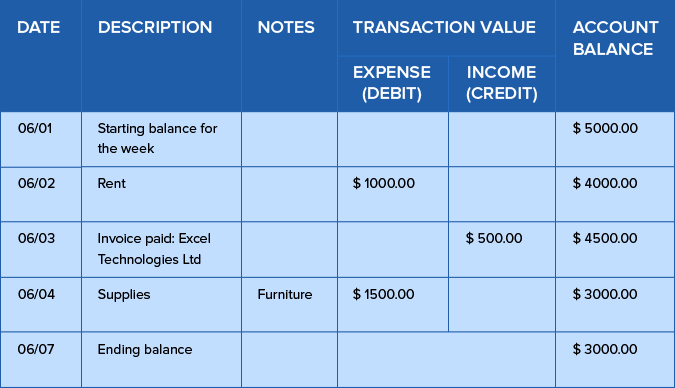

The receiving party is debited and another party is credited.

. I have transferred them to. DEFERRED TAXATION The annexed notes form an integral. It would be wise to separate this.

The finances of private limited companies are entirely separate from those of its owner s. Amount Due to customers is NOT the same as accounts payable. Two parties are involved one is the receiver and another is the giver.

The funds can be short term or long term which means they due within one year or due at any. Double Entry Accounting Type Of Accounting Zoho Books. Amount double due wallpaper.

Double Entry Bookkeeping Starting A Business And Its Initial Transactions Journal Entry For Loan Taken From A Bank Accountingcapital Related. I made journal entries as follow. You must keep a.

For an example you borrowed 30000 from your. For example suppose a business has an amount of 1000 owed by a customer for services provided on account but. - Line 2 chose Opening balance equity account and entered the loan amount in Credits.

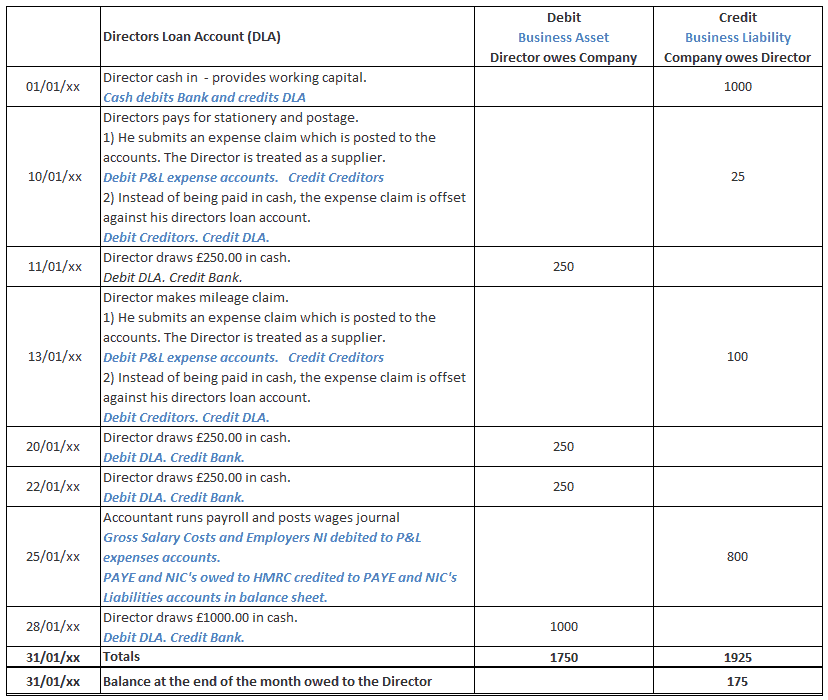

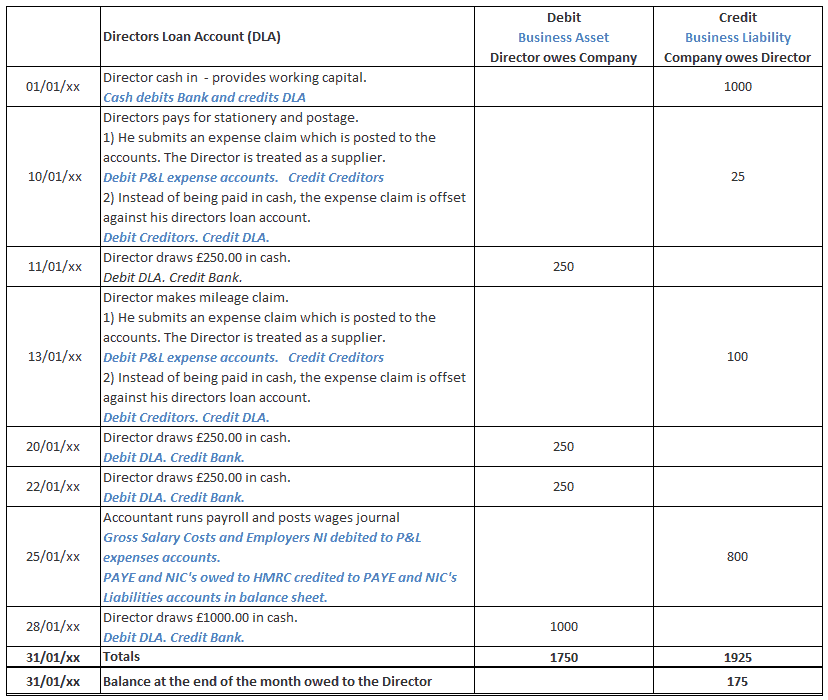

Thus the director can loan the company money. Features of Double Entry. For the firm what is the double entry for.

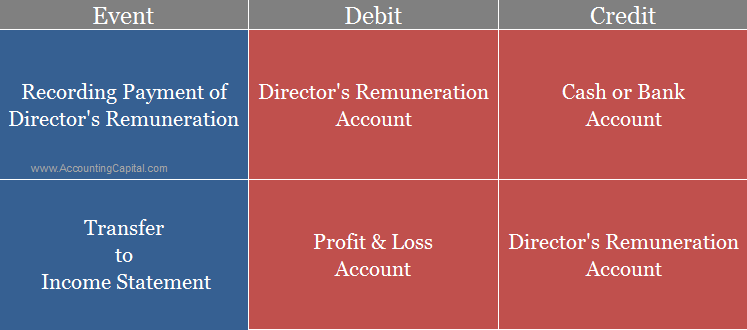

On 01 April the remuneration committee decide to pay the 10000 to each director. The board of directors for Unreal corp. AMOUNT OWING TO DIRECTORS The amount due to directors are unsecured interest-free and have no fixed term of repayment.

Amount due from director double entry. On 01 April the remuneration committee decide to pay the 10000 to each director. Approved a payment package of 100000 per month including the bonus for one of its directors.

The equation would look like 500000 0 500000. A contra entry journal is used to make the adjustment. As such double-entry bookkeeping relies heavily on the use of the foundational accounting equation Assets Liabilities Shareholders Equity.

Amount due to director double entry Accounts Receivable Double Entry Bookkeeping Double Entry System Of Bookkeeping Or Double Entry Accounting Efm Introduction To Bookkeeping And. Amount due to director double entry. Show accounting and journal entry for.

In order to achieve the. Pay an employee 5000 and you end up with. However due to the payment process and cash flow issue the payment is delayed.

Hence we have present value the amount due to Director at zero value. It operates on the principle that every transaction in one account has an equal and opposite entry in the other. The double entry accounting system means keeping the transactions in order.

The double entries is as follows. I use VT accounting software While reconciling bank I noticed few personal payments made by clients TA Company from his business account. This is because accounts payable is the term that is used to denote the amount that is payable to suppliers of the.

On 20 April the. A director lent 100K into a firm but the firm is always in loss and can only reply 79K. Amount due To Directors CR.

It is the amount of funds due to another party and is found in the general ledger. A Directors Loan is when you take money from your business that isnt a salary dividend or expense repayment and youve taken more than youve put in.

Journal Entries For Transfers And Reclassifications Oracle Assets Help

![]()

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

Journal Entry For Director S Remuneration Accountingcapital

Difference Between Single Entry System And Double Entry System Zoho Books

Bookkeeping Double Entry Debits And Credits Accountingcoach

Gnucash And Double Entry Accounting Example Business Rocketscience Llc

Double Entry Bookkeeping System Business Finance

Accounts Receivable Double Entry Bookkeeping

Double Entry Bookkeeping System Business Finance

What Is A Directors Loan Account Caseron Cloud Accounting

Accounting For Partnerships Fa2 Maintaining Financial Records Foundations In Accountancy Students Acca Acca Global

Double Entry Definition Examples Principles Of Double Entry

Bookkeeping Double Entry Debits And Credits Accountingcoach

Double Entry For Share Capital

![]()

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

Opening Entry In Accounting Double Entry Bookkeeping

Dividends Payable Debit Credit Journal Entry

The Accounting Equation And The Principles Of Double Entry Bookkeeping